One of the drawbacks from Free Speech is that lunacy and idiocy are free to be dispersed upon unsuspecting civilians. Such as Alex Green repeating the yell that HFT is a "boon...not a boogie-man" and that "HFT provide liquidity and tighten spreads". You'd hope this guy wasn't widely read or at least that he would be very rarely interviewed, but as InvestmentU puts it in their "Expert" descriptions: Alexander Green is the Chief Investment Strategist of Investment U. A Wall Street veteran, he has more than 20 years of experience as a research analyst, investment advisor, financial writer and portfolio manager. Mr. Green has been featured on The O’Reilly Factor, and has been profiled by The Wall Street Journal, BusinessWeek, Forbes, Kiplinger’s Personal Finance, C-SPAN and CNBC among others. So Mr. Green has been around and probably has connections to maintain the HFT Public Relations campaign as they fight the wave of reality that is being layed out by blogs like Themis Trading, ZeroHedge and firms like NANEX. It is not wise for one to opine on a topic they are not confident they understand completely. It's easy to say things like "there is no gold in China". To disprove it all one needs to do is find one piece of gold in China, be it on a necklace, in a pair of earnings, or as fillings in someone teeth. So when someone says "HFT provides liquidity and tightens spreads" all one needs to do is prove that HFT doesn't provide liquidity or tighten spreads. So how should we approach this? Graphing sequential data from the exchanges and graphing everything as it appears, in sequence, should do the trick.

One of the drawbacks from Free Speech is that lunacy and idiocy are free to be dispersed upon unsuspecting civilians. Such as Alex Green repeating the yell that HFT is a "boon...not a boogie-man" and that "HFT provide liquidity and tighten spreads". You'd hope this guy wasn't widely read or at least that he would be very rarely interviewed, but as InvestmentU puts it in their "Expert" descriptions: Alexander Green is the Chief Investment Strategist of Investment U. A Wall Street veteran, he has more than 20 years of experience as a research analyst, investment advisor, financial writer and portfolio manager. Mr. Green has been featured on The O’Reilly Factor, and has been profiled by The Wall Street Journal, BusinessWeek, Forbes, Kiplinger’s Personal Finance, C-SPAN and CNBC among others. So Mr. Green has been around and probably has connections to maintain the HFT Public Relations campaign as they fight the wave of reality that is being layed out by blogs like Themis Trading, ZeroHedge and firms like NANEX. It is not wise for one to opine on a topic they are not confident they understand completely. It's easy to say things like "there is no gold in China". To disprove it all one needs to do is find one piece of gold in China, be it on a necklace, in a pair of earnings, or as fillings in someone teeth. So when someone says "HFT provides liquidity and tightens spreads" all one needs to do is prove that HFT doesn't provide liquidity or tighten spreads. So how should we approach this? Graphing sequential data from the exchanges and graphing everything as it appears, in sequence, should do the trick.Alex Green is clearly playing the role of the "repeater". He has a high ranked title and writes for a widely read site, I think (The site is not read by us for any type of intelligence improvement, more for the sheer humor of its complete miss on certain topics).

So here is a guy that says fear about this is unwarranted:

Nevermind the fact that any money manager worth his twenty million cents knows that ask prices shouldn't be below bid prices (i guess the spreads are considered tight when they are negative):

Also remember in this post we mentioned that "Perhaps regulators’ biggest worry is over the unknown dynamics of the computerized stock market world that the firms are a part of — and the risk that at any moment it could spin out of control".

Then Mr. Green goes on to praise HFT saying "It’s a boon – not a boogie man – and puts only one group of traders at a disadvantage". I didn't realize events like Exhibit A and Exhibit B are boons, I would figure they actually ARE boogie men.

Exhibit A - Price execution before it is listed on the exchange for Yahoo

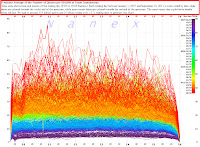

Exhibit B - Read the red box above the graph

The introduction of fear comes from a second statement which goes like this: "And, despite popular opinion, high-frequency trading did not cause the flash crash on May 6 last year. The SEC and CTFC have issued a joint report confirming that the crash was caused by a single large sell order on E-Mini futures contracts, a security that mimics trading in the S&P 500 Index".

The SEC states:

Against a backdrop of negative market sentiment and thinning liquidity, at 2:32 p.m., a large Fundamental Seller (a mutual fund complex) initiated a program to sell a total of 75,000 E- Mini contracts (valued at approximately $4.1 billion) as a hedge to an existing equity position

This large Fundamental Seller chose to execute this sell program via an automated execution algorithm (“Sell Algorithm”) that was programmed to feed orders into the June 2010 E-Mini market to target an execution rate set to 9% of the trading volume calculated over the previous minute, but without regard to price or time.

The execution of this sell program resulted in the largest net change in daily position of any trader in the E-Mini since the beginning of the year.

So they basically implemented Waddell & Reed in everything but their name. Eric Hunsader and his gang of wizards got their hands on Waddell & Reeds trades. Here is one chart and the rest of the chart covering that time period can be found here (note: explanations of the graphs are near the bottom of Nanex's page).

The green line is Total Waddell & Reed contracts executed up until that time.

Red price bars are range of prices of Waddell & Reed Trades in interval (same with the volume bars).

Perhaps you see the 9% trading volume rate the SEC mentioned, I don't:

Perhaps you see the 9% trading volume rate the SEC mentioned, I don't:

Next this Alex Green, Chief Investment Strategist at Investment U goes on to discuss that "HFT vacuum up nickles and dimes" and that they earn "$0.10 on 100 contracts". That is too round of a number to be accurate to me. It reminds me of Bernie Madoff's 45 degree angle of profits even through down markets, it just does not happen in this industry. Also HFT does not vacuum up nickles and dimes, they vacuum up hundred dollar bills:

And finally, to close, Investment Expert Alex Green repeats in typical sheeple fashion that HFT "spot and capture very small discrepancies" and states that HFT provide tight spreads and liquidity. So in closing to Calibrated Confidence's response I present these charts (remember we're talking light speed so focus on the time frame across the x-axis):

Loose Spreads

'Round The World Price Movement

An Eerie Knife From May 6, 2010

And here is the article for you to read. Let us know what you think and follow the developments in real-time as way to protect yourself with HFT Alert Pro.

And also, check out this post from @badalgo that shows "8 behemoths getting creamed". Nothing to fear here right Alex Green? At least he isn't a CFA.

From InvestmentU:

High-tech, rapid-fire trading is very much in the news these days.

Attendees at financial seminars and conferences tell me it scares them. Market pundits often say it distorts prices, creates an unfair playing field and punishes Mom-and-Pop investors. “60 Minutes” even jumped into the fray recently with an exposé on this new phenomenon.

The good news, however, is that investor fears about high-frequency trading are unwarranted. It’s a boon – not a boogie man – and puts only one group of traders at a disadvantage. And you shouldn’t be one of those types anyway.

Let me explain…

The Influence of High-Frequency Trading

High-frequency traders rapidly buy and sell large amounts of securities with statistics and algorithms that drive electronic-trading strategies. Using high-speed data systems, linkages with underground networks, and locations strategically positioned close to the servers of electronic exchanges, they compete to buy and sell in increasingly smaller fractions of a second.

Their influence is substantial. High-frequency traders now make up nearly half the daily volume on U.S. stock exchanges.

Critics claim that these traders are high-tech pirates who destabilize the markets and cost most market participants money. They’re wrong on both counts.

High-frequency traders are doing something that you aren’t doing anyway. They’re vacuuming up nickels and dimes. Daniel Weaver, Professor of Finance and Associate Director for Whitcomb Center for Research in Financial Services, points out that the average high-frequency trader’s profit is $0.10 on 100 shares traded. I’ll bet that’s not your own investment objective.

High-frequency traders spot and capitalize on very small discrepancies in bid/ask spreads among various exchanges. In the process, they tighten those spreads and increase market liquidity. These are both good things for us ordinary investors.

How about the complaint that high-frequency traders make stock prices more volatile? There’s no doubt that world equity markets have been particularly nerve-wracking lately. But there’s little evidence that this is due to high-frequency trading. After all, this technique didn’t begin with the market turbulence we’ve had over the last three months. This volatility has been driven by fear of a double-dip recession here at home and the currency crisis in Europe.

And, despite popular opinion, high-frequency trading did not cause the flash crash on May 6 last year. The SEC and CTFC have issued a joint report confirming that the crash was caused by a single large sell order on E-Mini futures contracts, a security that mimics trading in the S&P 500 Index.

Understand too that to the extent that stocks are volatile, it creates actionable possibilities. If a stock soars or plunges in the absence of news, it often creates an attractive opportunity to buy or sell. Prices fluctuate more than values. And to the extent that prices are out of whack, it increases your opportunity for gains.

High-Frequency Trading’s Biggest Losers

Who loses out due to this new high-tech trading? Mainly day traders, who are essentially gamblers anyway. I say that because intra-day stock-price fluctuations are almost entirely random. Most day traders would be better off betting on a coin flip. (At least there you have a 50/50 chance of winning.)

Day trading only works when you have a full-blown stock market mania – as we did internet and technology shares a little over a decade ago. When that kind of party ends, as it always does eventually, day traders go back to being bartenders and hairdressers. So to the extent that high-frequency trading deters these individuals, it helps prevent almost certain losses.

The important point is this: As a stock investor or trader, what you should really be concerned about is future earnings and share-price appreciation.

High-frequency trading – which increases liquidity and narrows spreads – does nothing to interfere with either.

Good investing,

Alexander Green