Once again we reach Friday and the amateur oil traders like to pretend to play with the big boys by talking about rig counts as if they are purposefully unaware of how to account for marginal utility improvements in a given rig over the past 50 years, but I'll digress.

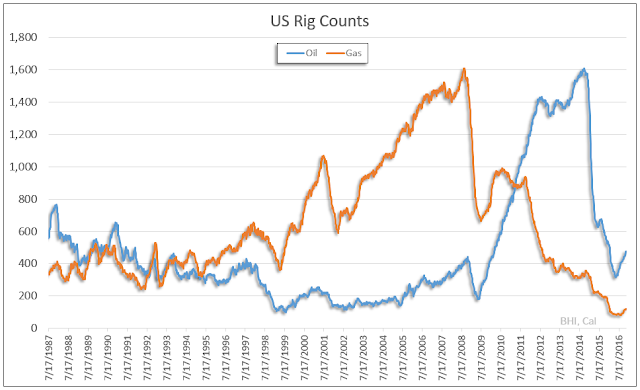

Yesterday I highlighted 20 charts from Credit Suisse on oil and they show the severity of the difficulty in getting a solid read on what to expect not just for this week's rigs release but even through H1 2017. Baker-Hughes rig data for Oil and Gas are due out at 1300 hours eastern time (source data). Oil rigs have been increasing each week for the past five weeks and have increased ~8%. Gas rigs have increased for the each of the past three weeks, up ~3.5%.

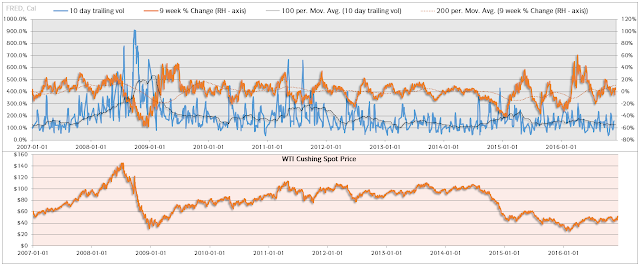

If you track the trailing performance of oil and slowdown the rate of change volatility that comes from the fat mouths of OPEC and the echo chambers of financial media muppets, you can see we are steadily climbing higher and this insight is further supported when we review the retail gas prices around the US.

Expect Diesel prices to continue to climb also as the data supports a steady increase.

But for the love of whatever god you believe exists, stop forecasting the global oil price based on rigs, it's not amateur night out here.

Yesterday I highlighted 20 charts from Credit Suisse on oil and they show the severity of the difficulty in getting a solid read on what to expect not just for this week's rigs release but even through H1 2017. Baker-Hughes rig data for Oil and Gas are due out at 1300 hours eastern time (source data). Oil rigs have been increasing each week for the past five weeks and have increased ~8%. Gas rigs have increased for the each of the past three weeks, up ~3.5%.

If you track the trailing performance of oil and slowdown the rate of change volatility that comes from the fat mouths of OPEC and the echo chambers of financial media muppets, you can see we are steadily climbing higher and this insight is further supported when we review the retail gas prices around the US.

Expect Diesel prices to continue to climb also as the data supports a steady increase.

But for the love of whatever god you believe exists, stop forecasting the global oil price based on rigs, it's not amateur night out here.