The CME Metals Inventory is an area not very well known to many, many people in finance. Just over a year ago I was informed of but never posted on, JPM's clearance (the Scribd document may have that doubling-effect to it so download the PDF for the legible version) to be a Licensed Depositor. On March 15, 2011 at 10:17, the CTFC received a confidential email I got my hands on. I uploaded it and linked to it in The Silver Corner. On the 15th the CTFC acknowledged the "application":

Usually the CFTC and CME along with other agencies will perform due diligence regarding CME Depositor License applications. This could take weeks if not months to perform. As you recall, in March of 2011 the underground world of finance recognized that JPM was manipulating the market, as told by Andrew McGuire and witnessed by a countless amount of us that traded it. This manipulation was connected to the "short-positions" taken on by JPM when they bought Bear Sterns. Instead of taking the expected weeks or months to perform Due Diligence, the CME granted JPM vault rights inside of 48 hours (document here).

Now this happened nearly 1 month before JPM earnings were released. I posted how JPM doubled their Gold inventory right before earnings. If you pull a Gold Futures chart you can see the price action when JPM took on 110,592 Troy Ounces of Gold, an increase from their prior day's levels of 359%. On May 3rd they increased their inventory again by 200,879 Troy Ounces of Gold, an increase of 142% from their prior day's levels. The problem back then was that when people short the SLV or GLD contracts, they do not deposit metals at the CME. So those short contracts that offered to the buyers have no actually metal backing.

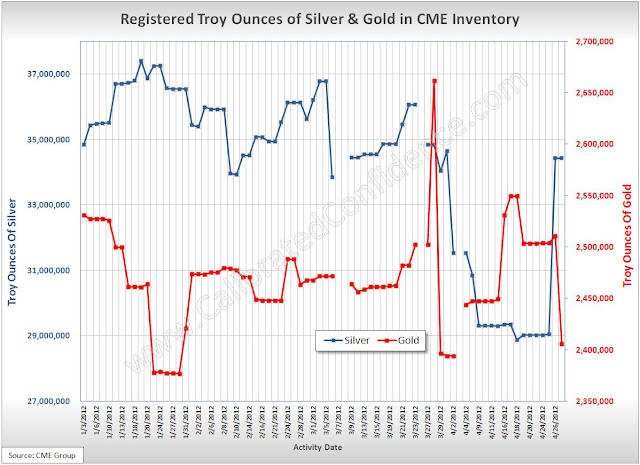

This effect coupled with others I'm sure I don't know about could be what is causing these disruptions in the inventories at CME, thus leading to pricing problems.

This effect coupled with others I'm sure I don't know about could be what is causing these disruptions in the inventories at CME, thus leading to pricing problems.

Exchange metal reported in the Registered category represents troy ounces of metal that meet the contract specifications as defined in the Exchange Rules (Chapter 112 for Silver Futures and Chapter 113 for Gold Futures)for which an electronic warrant has been issued. This is registered for delivery. You can see the metal's inventory levels fluctuate rapidly at the end of March. The down trend in Silver Inventory from the start of the year is sign that investors are taking delivery.

Exchange metal reported in the Eligible category represents troy

ounces of metal that meet the contract specifications as defined in the

Exchange Rules for which an electronic warrant has not been issued. This cannot be used to make delivery under a futures contract. Notice the level of Gold unusable for delivery drop off.

Total exchange metal reported.