At 10:00 today MF Global has another hearing. We know the story but what are the boring details, since we all know that is where the corruption takes place. Corzine is still free and it is amazing that this is not scrutinized with greater intensity. Here tonight, we plan to start from the simple question of "why Jon Corzine is not in jail?" and plan to increase in the depth of complexity of the situation and why this event is problematic to the way capital is distributed throughout the world. From the facts that we know, there is now a precedent for circumventing the sacrosanct rule of priority for segregated client funds. So what do we know?

We know, starting at the beginning, Section 4D clearly states the expected treatment of client funds. So from this, how does Corzine manage to not only break this rule, but managed to have his firm covered under SIPC protection while being able to remain free following $1.2Bn in stolen funds? There must be more at work.

We know Gary Gensler worked with Corzine at Goldman, which makes it understandable why he would choose to protect him over U.S clients. We all hook up our buddies, be it a drink or that extra 25% on their meal, and assuming these guys are scum, it's the behavior we would expect when it comes to over a billion dollar theft. That can't be it though. Someone in that Washington DC cesspool would use this case to get some votes for another term or whatever else his/her selfish purpose would be. Still though, there had to be a way that is more complex to make sure that morality could be rationalized to the point that it made sense to leave Corzine free as oppose to locking him up while at the same time so boring, none of the flashy American media would dare try to cover it outside of sound bites and headlines.

A few questions to bare in mind as we go deeper:

- Why did Gary Gensler recuse himself?

- How were CFTC rules worked around?

- What is the basis for leaving Corzine free?

Though we can't know for certain why Gensler recused himself, we can state with near 100% accuracy that it was because he knew of Corzine's situation and willingly held off passing new regulations that would have prevented Corzine from doing what he did. Sadly, it should be obvious that Corzine would have broken those laws too since he ignored Section 4d.

Aside from the treatment of customer funds, the CFTC has Section 1.25 which has been changed and as many, many useless laws are, the true meanings have been relaxed thanks to politicians selling their core values for soft money. However, that money had come from futures brokers, including MF Global, to get the CFTC to delay amendments that would have changed the breadth of Section 1.25.

Per Businessweek:

Per Businessweek:

"Gensler delayed the rule in July after being lobbied by broker-dealers and their executives including former New Jersey Governor Jon S. Corzine, then MF Global’s chairman and chief executive officer.

Corzine personally lobbied against the CFTC’s rule on client funds. “It will be costly,” he said in a June speech at a New York conference. Gensler recused himself from the probe because of his ties to Corzine.

Gensler worked at Goldman Sachs Group Inc. when Corzine was co-chairman, and was a Senate aide while the Democrat served as a U.S. senator from New Jersey".That's a beefy bit right there. The rule which was relaxed through lobbying by the industry that the rule regulated, was going to be amended until a criminal who had old connections with the individual regulating him managed to leverage his power and convince the regulator to hold off. That's enough to cover questions 1 and 2 but what about 3? Why was Corzine able to remain free even in the midst of all this information being known? A sharper question to contemplate is whether Corzine himself, as a person, is to blame or the system that is in place which enabled these actions through the perception of morality derived from behaving legally.

We highlighted the US law regarding Sovereign Nation defaults and ZeroHedge covered the complex European side. Corzine was able to managed his trades and the recording of them through the broad term "litigation arbitrage" used to identify the practice of scheming through the lobbyist watered-down laws around the globe. Specifically, MF Global took advantage of Europe's rehypothecation laws that enabled client assets to be pledged as collateral for other assets, many times over. This is a case where the reality of the law does not match up with perceived reality of moral governance. Still, in light of all the evidence that highlight the weaknesses of the fractional reserve fiat banking system, how is such a public bankruptcy (and the first to commingle client accounts, something even Lehman didn't do) slid under the public's eye with the main perpetrator being released?

We have a couple options that stay within the realm of sanity and off the fringes of the tin-foil hats:

- Government cover-up

- Legitimate confusion over the complexity of the various laws/jurisdictions involved

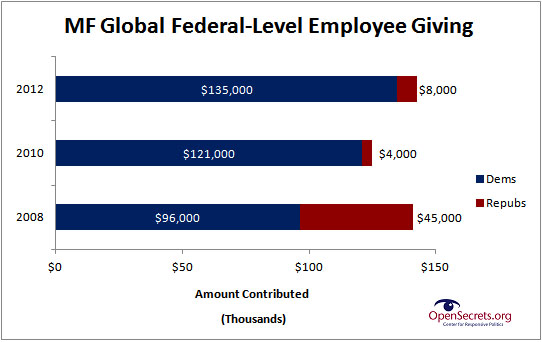

Off the bat option 1 seems the most plausible, given the US governments history to pervert public perception and standing facts. Consider that Corzine was well connected and knew that he had to pay-to-play. We also know he favored democrats over republicans.

Corzine was able to buy relationships by maintaining the status quo. So long as the money is coming in, the laws can be structured to keep justice away. Over Corzine's entire career he was able to build an image, somewhat like Madoff, that people never questioned. Gensler seems an easy enough push over since he not only worked under Cozine at Goldman Sach's but also shared the same political party that Jon so liberally lubricated.

Per NorthJersey.com:

Corzine was able to buy relationships by maintaining the status quo. So long as the money is coming in, the laws can be structured to keep justice away. Over Corzine's entire career he was able to build an image, somewhat like Madoff, that people never questioned. Gensler seems an easy enough push over since he not only worked under Cozine at Goldman Sach's but also shared the same political party that Jon so liberally lubricated.

Per NorthJersey.com:

Corzine, who shares his time between the New York apartment and his home in Hoboken, is no stranger to big money in politics. He had used his position as chairman of Wall Street powerhouse Goldman Sachs to become one of the nation's biggest "soft money" contributors to Washington Democrats when his name first began circulating in 1999 as a possible Senate candidate.So who from the democratic has decided to investigate their party's liberal donor's racket? Georgia Congressman David Scott, who has never received any direct money from Corzine or MF Global according to Open Secrets data beginning in 1989, is the lone democrat pressuring Gensler. This shifts the focus as the emphasis now going forward will be on the loopholes in the law and not necessarily Corzine’s accountability. Since this is the case, no one will be held accountable. The laws allowed MF Global's actions by not restricting them, there is no recourse for the clients. The government will not penalize itself, they will not jail themselves, so what's the recourse? Eat the dirt on this situation and pass a law that will hopefully prevent this in the future.

As he began spending what ultimately became more than $60 million of his own money to win a Senate seat in 2000, Corzine also contributed liberally to committees and candidates in New Jersey, especially county committees that are allowed to accept up to $37,000 per year.

He continued being a top contributor to the party while he served in the Senate and then at the State House. The New Jersey Election Law Enforcement Commission database, which does not include all political spending in the state, lists 329 Corzine contributions totaling $5.7 million to county and state committees and legislative candidates.

Most American civilians will be shocked and amazed someone could do such a thing. Considering where Corzine came from, it's not a surprise in the least. We're all well aware of Goldman lying to Congress and being let loose while Roger Clemens was indicted for using steroids as a professional baseball player. The democrats will give Corzine the benefit of the doubt and they'll focus on passing laws as an election talking point, this is nothing new to us. The roots that this group has together are too deep. Should the broad retail investor, which feeds this Ponzi scheme on the base level, loose faith in their third-party clearing house (broker/dealers, discount retail broker, any structured product clearinghouse), the system will loose its new suckers. Many farmers, merchants, and producers are worried about how to hedge the risks in their business cycles. This entire mess is a prime example of Normalcy Bias. This time though it's because of the survival instinct. No one wants to give up what they are good at doing and what they enjoy doing. A farmer will find a new clearing house and hope that things will change. The veterans in this industry will leave in frustration because they know too much to go on but they will be replaced by a new group will at least just dumb enough to not understand the depths of the problem MF Global just exposed in global capital markets.

Now that the political connection is made, SIPC's involvement is clear. The Chairman, Orlan M. Johnson, is a democrat and decided that protecting MF Global creditors was more important than enabling the real clients, 98% of them being commodities and derivative traders (not covered under the SIPA Liquidation), to recover their assets.

From FINRA: