$TWTR rebuffs hostile takeover offer from Jeff Skilling— CalConfidence (@CalConfidence) December 29, 2016

Lately I have been messing with the algorithms and the lazy jerkoff physicists hired by the banks and hedge funds to program automatic trading systems designed to take advantage of predictive order flow so that they can buy an equity at X and sell it to the retail flow milliseconds later at X+$0.0001. The impact I have had on the market would not even be remotely possible with real humans because real humans have read my tweets and know that what I'm saying is bullshit, however, the algorithms are still too stupid to determine veracity.

When Cal tweets about $TWTR we all:— CalConfidence (@CalConfidence) December 29, 2016

When the SEC allowed Reg-NMS back in 2007 they opened up Money Managers to excess risk, specifically, execution risk. There was and still is no way for large money/fund managers to determine the best way to execute orders that would enable them to achieve "best execution" because the SEC had unwittingly allowed Direct Edge and BATS (both ECNs and not full-fledged Exchanges) to create undisclosed order-type, the very order-types that destroyed Haim Bodek's Trading Machines (Who is Haim Bodek?) and countless other outlets, along with sub-penny execution that allow High Frequency Traders abusing these order-types to execute trades at $20.0001 and sell them to the institutional order-flow nano-seconds later at $20.0002. Reg-NMS generated something we call "Guaranteed Economics".

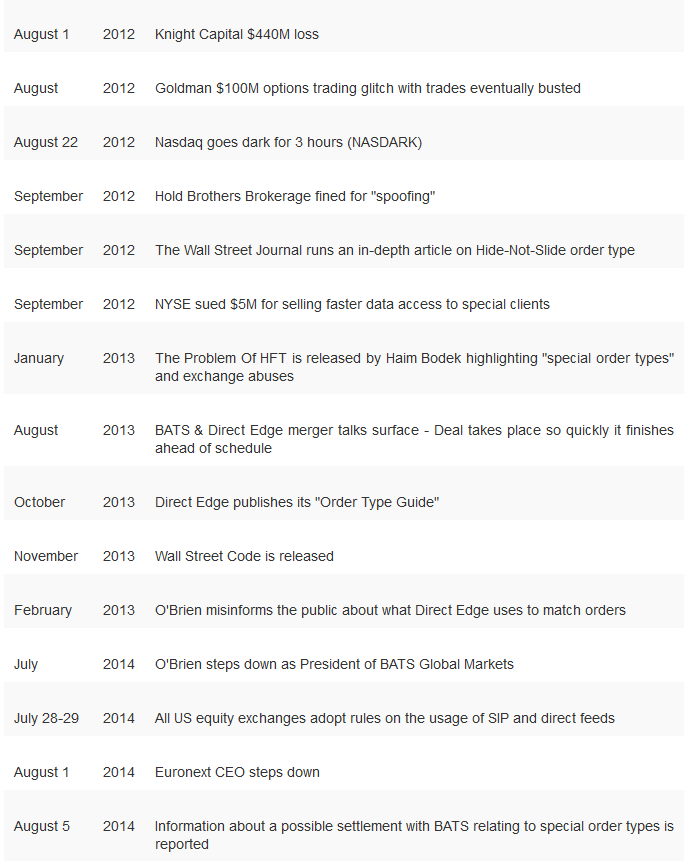

Timeline of HFT problems:

Timeline of HFT problems:

Those same order-types were reclassified years later after Bodek and the Sang Lucci team put out Wall Street Code. The WSC exposed the fraud at the exchanges and in order to hide the fraud from the over-worked and underpaid SEC, the exchanges, all of them, filed to reclassify their order-types as characteristics. The exchanges argued that Hide-Not-Slide and Post No Preference Blind Limit Orders were merely characteristics of the vanilla order-types: Market Order, GTC, Limit Order, Stop-loss, etc.

So what are traders and money managers supposed to do? We can't send orders to the market we have no intention of filing (Spoofing) so the next best thing is what you have blatantly seen me doing the past few weeks...tweet nonsense comments that would be read by HFT through the Twitter firehose and look for situations that would be detrimental to those who might choose to execute a trade. I can move stocks with my Twitter account. Nice "efficient market".

Even the Direct Edge founder couldn't explain what was happening in markets. He openly lied about how his exchange works, was forced to step down, did no jail time, and is now manipulating the bond market likely. It's just fucking amazing!

Even the Direct Edge founder couldn't explain what was happening in markets. He openly lied about how his exchange works, was forced to step down, did no jail time, and is now manipulating the bond market likely. It's just fucking amazing!

@CalConfidence then don't say we ignored it. You may not like current market structure but don't knock a good faith effort to explain it.— William O'Brien (@obrienedge) October 30, 2013

READ MORE: How O'Brien Lied On Air At CNBC About HFT

Think about that. A person with under 5,000 followers can Tweet anything (freedom of speech since I do not represent a news service any longer and I am just a lone person on Twitter) and some algo will try to predict order flow from that. The HFT will go out and bid or offer the stock, move the stock, then when no one comes in (because as you saw above, most everyone knows my Tweets are bullshit), the HFTs unwind that stupid predictive order-flow trade and the stocks reverse. That should not only intimidate you, it should scare you and frustrate the hell out of you that this is how broken our equity markets now are. And none of this is new.

We've been discussing this for years, YEARS! It took the pro HFT camp over 4 years to come out and try to say "liquidity is awesome" and "bid/ask spreads are tighter" and "the market is more efficient". Oddly though, in the aftermath of Reg-NMS in H2 2007, not one person was out here saying "dude, there is so much liquidity and the market is SO MUCH BETTER!"

I don't trade Twitter stock. I simply tweet nonsense and look to see who fires off trades. With that said, here are some examples of Tweets that moved the stock and you can clearly tell, as a human, what bullshit these tweets are (tweet times are GMT due to my VPN):

Think about that. A person with under 5,000 followers can Tweet anything (freedom of speech since I do not represent a news service any longer and I am just a lone person on Twitter) and some algo will try to predict order flow from that. The HFT will go out and bid or offer the stock, move the stock, then when no one comes in (because as you saw above, most everyone knows my Tweets are bullshit), the HFTs unwind that stupid predictive order-flow trade and the stocks reverse. That should not only intimidate you, it should scare you and frustrate the hell out of you that this is how broken our equity markets now are. And none of this is new.

We've been discussing this for years, YEARS! It took the pro HFT camp over 4 years to come out and try to say "liquidity is awesome" and "bid/ask spreads are tighter" and "the market is more efficient". Oddly though, in the aftermath of Reg-NMS in H2 2007, not one person was out here saying "dude, there is so much liquidity and the market is SO MUCH BETTER!"

I don't trade Twitter stock. I simply tweet nonsense and look to see who fires off trades. With that said, here are some examples of Tweets that moved the stock and you can clearly tell, as a human, what bullshit these tweets are (tweet times are GMT due to my VPN):

— CalConfidence (@CalConfidence) December 15, 2016

— CalConfidence (@CalConfidence) December 15, 2016

TRUMP APPOINTS IVANKA AS NEW $TWTR CEO— CalConfidence (@CalConfidence) December 16, 2016

$TWTR announces takeover offer at $22/shr from Enron and Solyndra, deal is all cash— CalConfidence (@CalConfidence) December 16, 2016

$TWTR says Russia hacked the market, caused the decline in stock price since IPO— CalConfidence (@CalConfidence) December 19, 2016

Dorsey: $TWTR is worthless, I should have sold my stake last year— CalConfidence (@CalConfidence) December 20, 2016

Pershing Square's Bill Ackman may be operating a Michigan bottle return arbitrage in effort to make all cash bid for $TWTR at $20 per share— CalConfidence (@CalConfidence) December 29, 2016

$TWTR rebuffs hostile takeover offer from Jeff Skilling— CalConfidence (@CalConfidence) December 29, 2016

Clearly these are entire nonsense tweets in the face of human logic BUT thanks to Reg-NMS and the SECs compromised nature, this kind of shit moves a stock and the only way for managers to hedge against execution risk without firing orders into the market to test the market, is to tweet some shit and watch the Virtu, BATS, Citadel algos go apeshit in an effort to garner some $0.0001 for themselves. This is utterly ridiculous and borderline fraud by the SEC for enabling this. But hey! The SEC caught Sarao so I guess we're all good now right? Nope!

For some added salt in the wound, remember that time I said Nikkei was buying Dow Jones for all cash then I reversed it and said Dow Jones was buying Nikkei for all stock? Even more ridiculous:

BREAKING: NIKKEI ALL CASH OFFER FOR DOW JONES INDUSTRIAL AVERAGE ON THE TABLE— CalConfidence (@CalConfidence) December 28, 2016

BREAKING: DOW JONES INDUSTRIAL AVERAGE TO BUY NIKKEI IN ALL STOCK DEAL— CalConfidence (@CalConfidence) December 28, 2016

And the SEC would love nothing more than for you to believe I'm the bad guy here, as if it's my fault that happens in a fragmented market loaded with front running order-flow algo predictors seeking sub-penny ticks to front run massive institutional order flow and skim whatever amounts they can out of the market. Yeah, I'm the bad guy:

No one cares anymore. We complain about Russian email hacking but our SWIFT Central Message System is hacked and no one cares. Our equity market structure has been hacked and no one cares.

Theft is always masked with complexity and in America complex things are kryptonite so people like myself who need to understand what's happening continue to feel the only way to understand a conflicted and compromised system is to game it with bullshit tweets protected by the First Amendment of Free Speech to gain a better understanding.

* * * * *

Until the SEC gets their shit together and stops catering to the big money centers like Goldman and Virtu I will have to continue to test to the system and potential screw you on a stop limit (for which I am sorry but there is no other option). Thanks a lot SEC, you guys are real heroes and I'm beyond shocked we continue to feed you $2B annually to do absolutely nothing.