GameStop has earnings on 03/27 at 0830 and analysts are expecting earnings to be $1.93. This analysis is the second half of this weeks trade analysis, read Part 1 covering BlackBerry (Earnings on 03/28 at 0800, here). I'm bearish on GameStop and have a reasonable fundamental price of $25.97 in place.

Current consensus revisions are down 2.58% to $3.02 from last years $3.10. The boom in iPads and computer based games has had better luck penetrating BRIC regions than did gaming consoles. This could most likely be attributed to standard of living fluctuations, as noted by IDC's report highlighting PC/Mac video game market will grow 4% annually until 2017.

"The forecast also found that global digital PC/Mac game revenue will rise about 4% per year between 2012 and 2017. North American digital PC/Mac gaming revenue, however, is forecast to slip at the margins over the forecast period. "

Compounding this "moat" breach into the generic gaming model of producing tangible disks playable on the buyers' console or his/her friends' console, is the advent of downloadable games and the inability to transfer the playing experience to a friends' system without a XBOX Live membership or other type for the other systems.

These games, from my experience when I purchased NHL 2014 for XBOX (tangent: I only bought an XBOX for the NHL series) sell for a rough $5 premium online ($60 for the download, $50 in the store used or $55 new in Upstate NY) and lack the advantage of trade-in value. The popular style of downloading now-a-days seems to enable the manufactures to establish this slight premium as most buyers will most likely rationalize the speed to get what they want and the easy of it in place of what they may pay in gas to drive to the store, forgetting about the "trade-in" value.

These games, from my experience when I purchased NHL 2014 for XBOX (tangent: I only bought an XBOX for the NHL series) sell for a rough $5 premium online ($60 for the download, $50 in the store used or $55 new in Upstate NY) and lack the advantage of trade-in value. The popular style of downloading now-a-days seems to enable the manufactures to establish this slight premium as most buyers will most likely rationalize the speed to get what they want and the easy of it in place of what they may pay in gas to drive to the store, forgetting about the "trade-in" value.

Speaking of trade-in value, here's Walmart:

"Starting Wednesday, March 26, customers will be able to trade in their video games and apply the value immediately towards the purchase of anything sold at Walmart and Sam’s Club, both in stores and online. The traded-in games will then be sent to be refurbished and made available for purchase in like-new condition at a great low price."Now GameStop has some series headwinds that will undoubtedly be discussed in the conference, blasted across Benzinga and Bloomberg headlines, and also written about across financial news website (in article read by news-reading algo's of course).

Here's the same images from the BBRY article that very breifly sums up what I'm looking at for GameStop:

GameStop also lowered guidance for their Q4 numbers:

|

| Individual Performance & Key Year-To-Date Headlines |

Jumping into the .xls file, we have the output for the financial statement analysis:

|

| Data Source: Mergent Online, Yahoo! Finance, Reuters, Capital-IQ, US Treasury, CNBC, And Zack's Research |

The story is the same with GameStop as it is with BlackBerry regarding the destruction of ROE, ROA, and Profit Margins. The difference here is that I'm expecting GameStop to perform worse than what everybody is expecting whereas with BlackBerry I'm expecting to not perform as bad as everybody is expecting.

You can also see GameStop has a Inventory Period problem that has been growing since 2008 and along with the global expansion of new mobile gaming platforms. Again, this Inventory problem could be attributed to the domestic growth in mobile based gaming platforms.

So what do I calculate the intrinsic price to be?

|

| Model Price |

Capital IQ analysts expectations:

|

| Capital IQ Analyst Estimates |

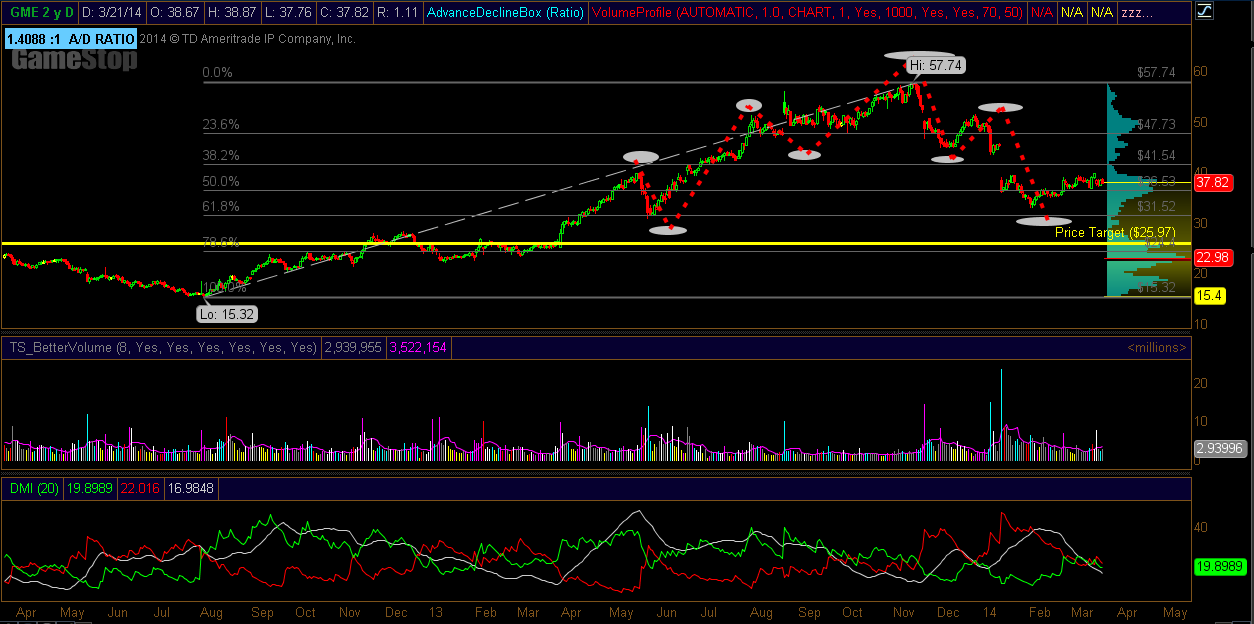

Hitting that level in one earnings cycle will be difficult, however, I do view the potential move in GME as being more profitable to me than the exposure to the risk of BlackBerry's EPS release. Looking at a chart for GME shows it has completed a recent Elliot Wave cycle and is set to begin a new down or up trend, I'm leaning toward down trend based on the YTD trend and the nearly complete retracement of the boom move that started in April last year.

GameStop (GME) 2-Year Daily Chart

|

| To Download To Your TOS Platform ---> http://tos.mx/WgzIlF |

Listen --> http://investor.gamestop.com/phoenix.zhtml?c=130125&p=irol-EventDetails&EventId=5114792

GameStop Excel link click here and then select download from the drop down in the upright of the page.