Alright guys, it's Monday and we have a closed bond market. Let's keep it short and sweet.

I'm still watching Tesla, even after the fire and the subsequent "paid-advertisement" from the driver (of said steel fireball that was generated and offered to the world in the form of a blog post. Everyone has been giving Tesla flak over the recent spat of fire-car stories. Yeah, it sucks, but you're not going to die with any higher probability than what you experience driving down a two-lane, two-way road, with cars doing 45 MPH passing each-other in opposite directions a mere foot apart. Keep it in perspective.

So, with that said and my claims about Tesla's $60-75 valuation depending on your assumptions, how does the price performance look from the $194.9 high from back in early last month (October 1st)? Overall, the consolidation continues and using the Fibs in the falling market is highlighting the support around the $124.73 range. I see Tesla remaining stuck between 124 and 138 for the time being as headline-reading news algo's batter the stock and enjoy a friendly game of hot potato at these levels until the trading ends and buyers step back in. The support for Tesla's price under 160 collapsed as profit takers sold shares and reallocated capital weeks ahead of this bearish movement. The correction was bound to come on some form of net-negative news. To keep it short, I'm still bullish.

Tesla 4-hour intervals -

The S&P 500 E-Mini futures are in a holding pattern that highlights a bearish tone, which is difficult for me to accept especially given the short I had that failed and my expectation that we'll get the November to year-end Santa rally and the general Q1-2014 rally (highlighted in blue below). It's a mixed signal right now but I'm adding weight to the rally behavior over the bearish behavior.

ES_F Weekly for 10 Years -

ES_F 4-Hour Intervals -

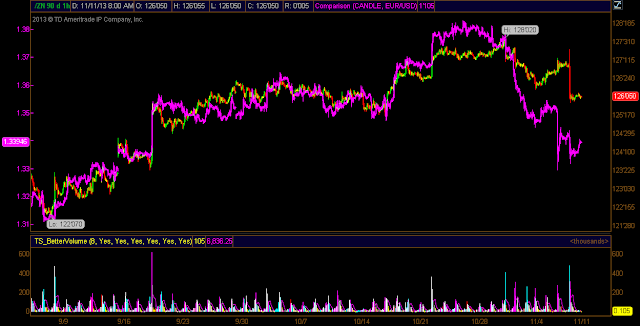

Overall, look for this week to either offer a break-out to the ES_F upside (doubtful) or for the status-quo of sideways chop to continue. Until that breakout to the upside comes, set-up your trades to capitalize on the late November or early December rally leg. Finally, keep an eye on the behavior of the EUR/USD and the US 10 Year Constant Maturity Treasury futures:

US 10-Year Futures versus EUR.USD (Pink Candles) - 90 Day/1 Hour chart -

That's all. If I don't get you a mid-day update on here, catch me tonight at 9PM EST on Calibrated Confidence Corner BTFDtv.com. Cheers.

Closing thought:

Alan Watts on the "energies of life" and the "excess" of them resulting in "going to far". Consider what he is saying and how it applies to this new Wall Street of price setting which is based upon Order-Type usage, the Race To Zero and next tick predictions in place of intrinsic valued firms whose stock matters because of its value, not just because it's the conduit to using Order-Types to make Alpha. Learn from younger generations.