"The only fully adequate data currently available for academic research on high- frequency trading come from regulatory records that the Chicago Mercantile Exchange provides to the U.S. Commodity Futures Trading Commission"

This is a sentence from the first page of a newly released white paper on HFT and Exploratory Trading. You may remember reading the article from Bloomberg where the CFTC suspended their academic research program because of data handling concerns. Funny how when it's the regulators data they get in a tissy but when its traders complaining about data handled incorrectly it falls on deaf ears

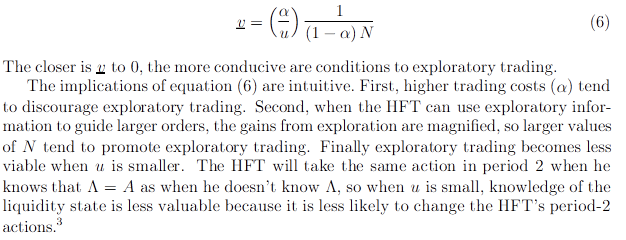

Well funded HFT houses have an ability because of their processing power, speed, and Guaranteed Economics in the form of special orders in exchange of trading volume, to participate in exploratory trading (ET). ET offers insight into supply conditions by placing orders and observing how price and supply respond.

The paper describes the game that our market has become. As Joe Saluzzi states in Ghost Exchange "that's not a market, it's a game" because the strategy involved has underlying fundamentals such as a company's performance or in the place of this paper the economy's performance (the e-mini data is used in the paper).

"If the HFT places an aggressive order in the first period, he effectively “buys” supply information that he can use in the second period to better decide whether he should place another aggressive order. Consequently, the HFT may find it optimal in the first period to place an order that he expects to be unprofitable, since the information that the order generates will be valuable in the second period"

Exploratory Trading can be costly but the information gained tends to be priceless as there no way to gain the insight without a (costly) ET order. If time passes in terms of Periods, than ET is used in Period 1 to determine the state of liquidity on the order book. The information gained from Period 1's analysis of liquidity is used to determine the trade type (if any) to executed in Period 2. So on and so on goes the computational process attributed to today's low-volume, over-priced equity market environment.

As this form of trading continues to rapidly engulf the structure of the financial market, we deviate further from the fundamental analysis of price setting to the time period analysis of price setting. The problem now becomes that the time periods used are beyond any human processing ability and our ability to intervene is null, therefore introducing a new risk to the market, that of the well funded automated market maker introducing say their test algorithm in place of their real-world algorithm.

And in a world were every exchange as its own personal, non-standardized Retail Liquidity Program, chaos is introduced thanks to the latency of technology and the SEC's admitted inability to enforce laws because of this latency which exists upon the boundaries of the speed of light.

Now that the speed of light is annoying to our market makers, the pricing of all our real world assets is left to a few quants and an equity market that behaviors in a universe inaccessible to us when it is in operation.

The metaphysical nature of this reminds of the Eddie Vedder song Society (Paper embedded after the video):

As this form of trading continues to rapidly engulf the structure of the financial market, we deviate further from the fundamental analysis of price setting to the time period analysis of price setting. The problem now becomes that the time periods used are beyond any human processing ability and our ability to intervene is null, therefore introducing a new risk to the market, that of the well funded automated market maker introducing say their test algorithm in place of their real-world algorithm.

And in a world were every exchange as its own personal, non-standardized Retail Liquidity Program, chaos is introduced thanks to the latency of technology and the SEC's admitted inability to enforce laws because of this latency which exists upon the boundaries of the speed of light.

Now that the speed of light is annoying to our market makers, the pricing of all our real world assets is left to a few quants and an equity market that behaviors in a universe inaccessible to us when it is in operation.

The metaphysical nature of this reminds of the Eddie Vedder song Society (Paper embedded after the video):