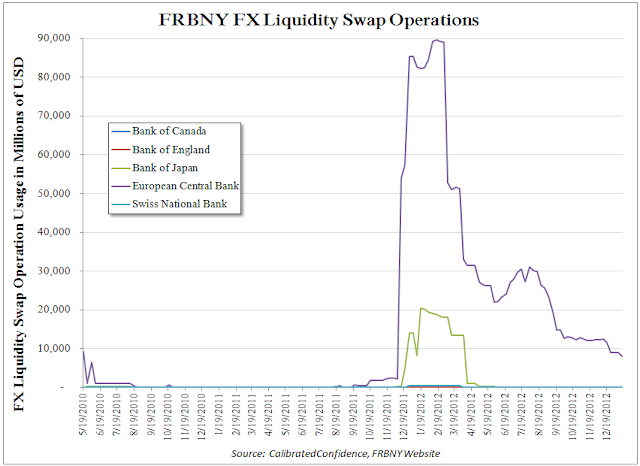

According to the levels of the FRBNY FX Swap lines, Europe appears to

be experiencing a momentary lull in the stress on its banking system.

The latest reading on the lines that Bernanke assured Senator Corker he isn’t using were pegged at the lowest levels since this all began on December 14, 2011.

Swaps to ECB only:

Swap usage by all parties:

At the same time Money Market Fund levels are beginning to show better signs of life relatively speaking:

For some perspective since 2009:

Before you go and assume all is well, bear in mind that on the “margin”, investors are in the red. Nothing a little Treasury minting can’t solve.

Via Bloomberg Businessweek:

Swaps to ECB only:

At the same time Money Market Fund levels are beginning to show better signs of life relatively speaking:

For some perspective since 2009:

Before you go and assume all is well, bear in mind that on the “margin”, investors are in the red. Nothing a little Treasury minting can’t solve.

Via Bloomberg Businessweek:

Experts were skeptical last summer when Mario Draghi gave the speech that saved Europe. Draghi, the president of the European Central Bank, told a London audience that the ECB would do “whatever it takes” to save the euro. At the time, the bespectacled, 64-year-old central banker had nothing to back up his promise. Economists quickly noticed his bravado was out of the fake-it-’til-you-make-it school. “Draghi is damned if he does and damned if he doesn’t,” Carsten Brzeski, senior economist at ING Group (ING) in Brussels, told Bloomberg News. “He maneuvered himself into an extremely difficult situation. Expectations are very high.”Against long odds, Draghi’s bluff worked. Bond markets rallied on the belief that the ECB would deliver on its promise. The market’s surge fed on itself, adding to Draghi’s credibility. Then he recruited German Chancellor Angela Merkel to his side, splitting her off from Jens Weidmann, the hawkish head of Germany’s central bank, the Deutsche Bundesbank. On Sept. 6, the ECB Governing Council put money where Draghi’s mouth was, committing to buy unlimited quantities of sovereign debt if the issuing nations agreed to strict conditions aimed at getting their finances back in order. (Only Weidmann dissented.) Spain and Italy were the main intended beneficiaries.Amazingly, the ECB has not had to follow through and buy a single euro’s worth of Spanish or Italian bonds. The open-ended commitment to do so was enough to get private investors to buy. Borrowing costs in the two countries are affordable once again. As the global elite convenes in the Alpine resort of Davos, Switzerland, for the World Economic Forum on Jan. 23-27, the European economy looks a good deal less scary than it did a year ago. For that, Europeans can thank the unassuming moneyman they call Super Mario. Even Germans are impressed. “I was way more critical—I have to admit that—in September than I am today,” Nikolaus von Bomhard, chairman and chief executive officer of reinsurer Munich Re, said in a Jan. 15 interview.What Draghi grasped last summer in London was the importance of “multiple equilibria,” the idea that an economy can operate persistently on either a full-employment track (good) or a low-employment track (bad). Government, Draghi realized, can flip an economy from a bad equilibrium to a good one. Others are following his lead. In Japan, newly seated Prime Minister Shinzo Abe is trying to work a similar flip by urging the Bank of Japan to break the nation’s deflationary spiral. In the U.S., in contrast, the sickening standoff over the debt ceiling threatens to execute a back-flip to a low-growth equilibrium.Draghi’s training prepared him to be bold. He earned his doctorate in economics in the 1970s from a school that emphasized activism over faith in markets: Massachusetts Institute of Technology. Ben Bernanke was a fellow student. Later, Draghi got a feel for the instability of financial markets during a stint at Goldman Sachs (GS). Recall that former Treasury Secretary Henry Paulson, who had been CEO of Goldman, pulled a Draghi-like move in the summer of 2008 when he promised support for Fannie Mae (FNMA) and Freddie Mac (FMCC), saying, “If you have a bazooka in your pocket and people know it, you probably won’t have to use it.” (Alas, Paulson did have to use his bazooka—and it wasn’t enough to prevent a financial meltdown.)The key insight of the “multiple equilibria” theory is that the demand curve can develop an ugly kink during a crisis. A falling price, rather than attracting buyers, can scare them off. No one wants to catch a falling knife. The real economy is quickly affected by the market plunge. When governments’ borrowing costs go up, they compensate by raising taxes or cutting spending. Businesses’ borrowing costs rise, too, so they cut investment. Low prices on bond portfolios leave households feeling poorer, so they try to save instead of spend. The economy gets stuck in neutral, if not reverse.But just as pessimism can become a self-fulfilling prophecy, so can optimism. By getting investors to believe that better times were ahead, Draghi made bond prices rise and yields fall, which aided the real economy and produced the (somewhat) better times that investors were betting on. Says David Kelly, chief global strategist for J.P. Morgan Funds (JPM): “This is something Europeans could have saved themselves a great deal of pain by recognizing from the start.” Euro optimists got another boost in November when the European Parliament approved plans for the ECB to take on bank oversight duties.All that said, Europe isn’t out of the woods by any means. Output in the 17-nation euro zone has been flat to sinking since late 2011. Unemployment is 16 percent in Portugal and 27 percent in Spain. (To sense Spaniards’ pain, check out the poignant YouTube (GOOG) video of musicians playing Here Comes the Sun in a Madrid employment office.) Output is likely to keep shrinking through the first half of 2013, according to economists surveyed by Bloomberg News.Political splits within Europe are complicating recovery. “The pro-reform coalition in Athens is fragile,” economists at Berenberg Bank wrote in a Jan. 11 research note. They warned that Italy’s elections next month might derail reform and said, “France still shirks the serious reforms it needs to arrest its long-term decline.”

But the strongest headwind for Europe is deficit-cutting—even by countries such as Germany that face no market pressure to balance budgets. Here, Draghi isn’t doing himself or Europe any favors. He supports harsh austerity measures, even though the International Monetary Fund has begun to warn that they cause “significantly” more unemployment than forecasters once estimated. There’s only so much the ECB can do on the monetary side to offset tightening on the fiscal side. Another interest-rate cut could force the deposit rate into negative territory, which might hurt lending between banks and money-market funds. Brzeski, the economist who warned last summer that Draghi had maneuvered himself into a difficult position, remains worried. “The ECB will secretly keep its fingers crossed, hoping that better financial market conditions and structural reforms eventually really lead to an economic recovery,” he says now. The good news: “The crisis has delivered a surprising degree of wage flexibility and labour mobility,” Charles Wyplosz, an economist at the Graduate Institute in Geneva, wrote in an article for the VoxEU website on Jan. 4.

Draghi permitted himself a bit of self-congratulation in a news conference in Frankfurt on Jan. 10. “We are now back in a normal situation from a financial viewpoint,” he told reporters. “We spoke a lot about contagion when things go poorly, but I believe there is a positive contagion when things go well.” Take a bow, Super Mario.

With Carol Matlack and Jana Randow