Insane quote spamming today. I'll show you screen shots of each stock specific blast but as of 11:52 AM Bank of America has became the focus point of a serious algo quote spamming operation. According to Nanex, BAC alone today has seen a 7 fold increase in its quote/trade ratio since 2004. Naturally, the entire crew was on top it.

On November 1st, there were 178 seconds where the number of quotes in BAC exceeded 17,000; a total of 3.2 million quotes. During those seconds, only 986 trades executed. For the entire session between 9:30 and 11:10, BAC had 3.7 million quotes and 51,000 trades. Which means 86% of all BAC quotes occurred in those 178 seconds. Which means it is likely that one algo from one firm (all of this quote spam is from Nasdaq) is responsible for 86% of all canceled orders in BAC.

The chart below shows the daily quote to trade ratio in BAC between 2004 and 11:10am on November 1, 2012. The spike on the right at 73 is through 11:10am on November 1st: 7 times higher than normal.

BAC - Daily Quote Counts between 2004 and November 1, 2012 (up to 12:45pm)

The spike on the right at 7.8 million is through 12:45pm on November 1st.

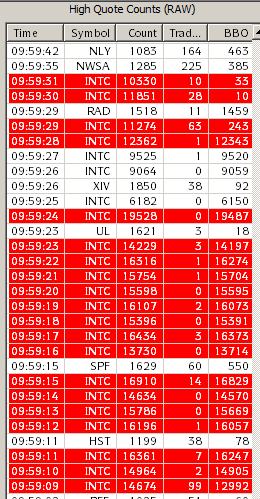

This has got to stop. You can see under the count column in the following table on the far left that sequences were sending 18,000+ quotes and only making 1, maybe 2 trades and changing the Best Bid or Offer upwards of 17,000 times, per second! This amount of processing at the exchange produces a major delay and highlights the HFT M/O regarding placement of their orders in optimal locations within the order queue prior to hitting the matching engine.

Table from HFT Alert:

This same form of dud munition was sent to Ford, Intel, Morgan Stanley, Yahoo, and Sirus Radio.

FORD

YAHOO

INTEL

Morgan Stanley

#GoodLuckHuman