CNBC and the news media failed to produce enough hype to bring retail investors back to the market. In a dud release, the common equity of the most basic and pathetic American business wound up requiring the support of the underwriters who stood to lose money as the high frequency traders played around the $38 IPO price. The average Joe is still avoiding the market and HFT are still behaving in ways we have reported, manipulative and damaging.

The latest headline IPO's, BATS and FB, both bombed publicly and failed to generate enough wealth for those involved to feed the euphoric, dream-chasing mind set so cherished by the general American populace. Trading was to begin at 11 AM EST, then it was postponed for 5 minutes. Then it was ten minutes. Then it was 5 more minutes. Then Europe closed and the FB shares began to trade.

Notice on this chart below the two points where the equity traded at $38.00. Off the initial release, 20 minutes in the stock went from a wide spread to a five cent spread. From there, the stock forms a bell shape, until HFT and Underwriters go to battle again at $38 into the close. The after-hours trading provided opportunities to capture 7% gains as the trading range was maintained to $38 and $42.

Watch this video on the battle between the HFT and the Underwriters as both key in on the $38 level during the first test of $38 between 11:50 and 11:55

(h/t Dennis Dick at PreMarketInfo.com)

This chart comes from Nanex's Facebook IPO report and covers the initial trading of Facebook shares:

50 Seconds and 700 Milliseconds

Chart 3. All bids and offers color coded by exchange.

5 Second interval of the first hour and 15 minutes of trades and quotes.

HFT Alert Pro showed me that FB was being traded on BOST with HFT identified quotes. BOST was the only exchange I saw until 11:55:10. At this time the machine began placing orders, simultaneously on BOST and BATY then at 11:55:12 doing the same thing on BOST and BATS.

50 Seconds and 700 Milliseconds

Chart 3. All bids and offers color coded by exchange.

5 Second interval of the first hour and 15 minutes of trades and quotes.

HFT Alert Pro showed me that FB was being traded on BOST with HFT identified quotes. BOST was the only exchange I saw until 11:55:10. At this time the machine began placing orders, simultaneously on BOST and BATY then at 11:55:12 doing the same thing on BOST and BATS.

Looking at zoom view, we can see the long extension candles.

These trades were canceled. Here are the busted/canceled trades in FB during the 11:50:00 to 11:55:59 period

This chart shows the clear spike in algo activity as 10 stocks were hit on the BATS nearing the end of the 11:55 minute, just prior to the price run up

Zoom of same chart

At 12:22:00 PM EST another buying program entered orders that stopped FB from dropping again and helped to spike the price before it stabilized for about 90 minutes

On this blast the program executed simultaneous trades in an effort to capture millisecond arbitrage as the program had knowledge of the orders executed in 2 separate geographic locations. When these orders were place, the latency of light carrying the trade information from say BOST to PACF to BATY enabled the program to profit since ti knew what happened in these locations before the exchange could share the information with each other.

The program finished at 12:23:24

The activity in Facebook regarding Cycle Repeaters was like something I've never seen before. All day FB was the only stock to be hit with Cycle Repeaters. The programs ran the gambit on FB.

BSFC = Bid Size Fall Cycle

BSCC = Bid Size Conical Repeater

More on Cycle Repeaters here (refer to top 3 images under the "Examples" tab)

This is an example of a bid price cycle repeater from Google on September 16, 2011

The algo's were all over this stock today. As the media was used to foment excitement in the stock, programmers were hoping retail traders would come back so they could be taken advantage of. Those unaware of the manipulative ability of HFT and the dynamics of their interaction on IPO days with Underwriters, were burned today. Hopefully in the future our regulators that we pay for through our slush fund of a tax pool with the US Gov't will use more discretion before allowing manipulative actions to sneak into the market.

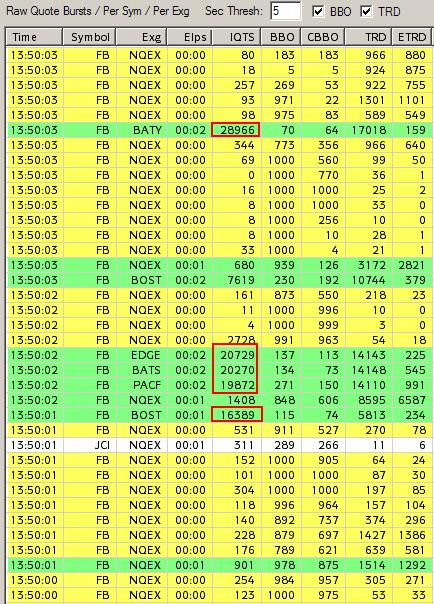

The action at the end of the day was similar to what I just described for the late morning, early afternoon session. Here are charts of very high Facebook quotes. Remember to add 1,000 quotes to the number in the box, that is the minimum quotes needed for the program to pick up the HFT activity. TRD is all trades. ETRD are exchange specific trades. ELPS is the time required for the sequence to run from beginning to end. BBO is the number of times a quote in that sequence was the Best Bid/Offer and CBBO is number of times the quotes changed the Best Bid/Offer

Chart 1

Chart 2

Chart 3

Chart 4

Chart 5 (Largest quotes of the day with 38,139 quotes and 24,041 Trades)