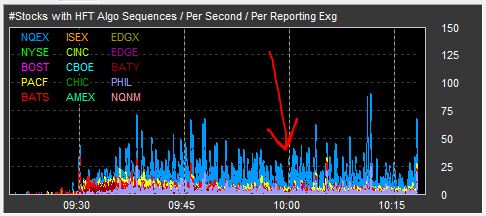

This afternoon heavy sellers entered into the market. Using HFT Alert Pro and HFT Alert charting we can observe the spike in the HFT Algo sequences, per second, across 15 exchanges, in real-time. The predominate spike came on the NASDAQ which #NanexLLC twittered was delayed by nearly a second. These are the benefits of HFT Alert Pro and HFT Alert. Using both platforms at once allows me to zoom on a 10 minute time frame and also have a visual for the entire day so I can keep the movements in perspective (think of a Daily stock chart along with a intra-day chart).

This afternoon heavy sellers entered into the market. Using HFT Alert Pro and HFT Alert charting we can observe the spike in the HFT Algo sequences, per second, across 15 exchanges, in real-time. The predominate spike came on the NASDAQ which #NanexLLC twittered was delayed by nearly a second. These are the benefits of HFT Alert Pro and HFT Alert. Using both platforms at once allows me to zoom on a 10 minute time frame and also have a visual for the entire day so I can keep the movements in perspective (think of a Daily stock chart along with a intra-day chart).

With the program I am able to mesh the importance of monitoring high frequency activity with my usual measurements of volume, depth, breadth of markets. The additional ability available to subscribers to understand the activities of what has been reported to be 70% of US equity markets is what investors who desire positive Alpha seek. This additional tool now available has changed my personal trading within a week.

Now that I know the algo's have raided Tony Montana's stash, I have been able to stretch my entry and exit points, confident that computers will (and have) traded outside the NBBO. Yesterday I saw that PSLV was being attacked early and set my ask at $15.85 only to have it fill with 15 minutes of my observation. I missed the SLV play today but I will post what HFT Alert showed me in real time sometime in the next 36 hours. Don't worry though, the SEC isn't doing anything to stop this behavior anytime soon so you have ample opportunity to pick up the software (HFT Alert will have going with a couple hours if you sign up during non-market hours) and piggy back with the select few who are aware of this type of behavior.

PSLV Chart

Before the 10:00 hour I notice the drop off in identified HFT Algo Sequences which wound up reaching its high for the morning only 15 minutes later, when I noticed activity in the market I trade in.

Following that, just prior 10:15, I entered my order after seeing the spike and confirming the activity with the HFT Alert Quotes/Sec/Exchange chart.

This activity was a clear "fluttering" experience and with the information I had available because of HFT Alert Pro and HFT Alert, I was able to place my sell order sooner than I would have other wise.

For the number of quotes on SLV and ProShares Ultra Short Silver ETF there sure were a small amount of orders being filled. The last column on the High Quote Count table is the number of times the HFT's were able to make the Best Bid Offer, a point at which I'm sure they filled every, single order. This was the thought process at 10:13 and only later was this confirmed through a chart created by NANEX.

PSLV 133k Chart

The following charts are from NANEX and they prove what I initially expected would happen when HFT Alert identified the abnormal behavior for me. Coupling this real-time information with my market knowledge enabled me to profit and also have certainty in my perception of markets, something key to all solid and consistent investors (we need to justify why other people pay us to take risks with their money and this software makes that justification that much easier).

From 10:33 to 10:38 - PSLV

From 10:33:46 to 10:34:03 - PSLV

This is how the HFT's work: They trade and manipulate the prices in a broad range of similar assets or financial vehicles. I was holding PSLV but caught activity that isn't normal in SLV and ZSL which allowed me to trade PSLV on the expectation that it would have a fast upside given the hedge the HFT took with the Ultra Short Silver EFT.

If you spend time in markets and you find yourself wondering "what the hell was that?" you now have access to a platform that will only help you and also help those of us who are interested in arresting this behavior since the SEC won't. This is the first tool of its kind that allows me to see "what the other guy" is doing. Usually I guessed that by looking at the price but now I can actually SEE them, there is not hiding within the tape anymore. Knowing the breadth of the financial assets that have HFT activity in them at any given moment is what enabled me to profit on this specific trade with the specific information deduced through HFT Alert's software.

Keep in mind, SOMEONE ALWAYS KNOWS when news is coming out or a downgrade is set for release. When those people push the button to profit of that information, we can see it in real-time and which assets will be affected.

This is another prime example that the private sector can produce better goods on their own. The SEC has no way of either A) creating this software since they don't think HFT has any negative effects on market or, B) being able to deduce what it means for transactional risk at the point of sale. This is a clear cut example of how individuals are able to create goods and services. I'm sure about you but this is not the type of behavior I wish to suppress or tax. Thank you HFT Alert for being stand up human beings, you have personally helped me profit and sleep at night while markets are in a new normal of high volatility and extreme uncertainty. You also have built a product with incredible quality.