From Nanex:

Usually when algorithms go haywire in the markets, they execute trades at wild prices; many of which will later be canceled. 'Pretend it didn't happen' is the current mantra of our regulatory agencies. The regulators would also appreciate it if you didn't talk about these events as they could harm investor confidence. What country are we in?

Until firms are held responsible for their actions or the actions of their technology, the haywire algo's (and the companies that deploy them) are free to do it again and again.

Presented below are three examples. You won't find these trades in most databases any longer, they have already been scrubbed (they didn't happen).

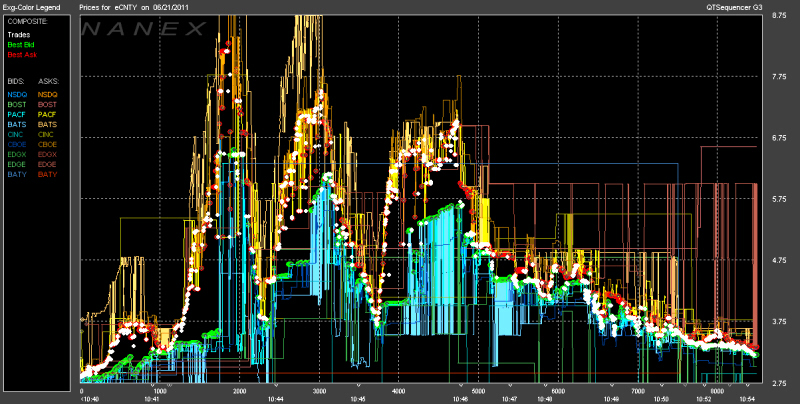

The following chart plots quotes and trades of the stock CNTY on 06/21/2011. The stock cycled violently from approximately $2.75 to $8.00 several times:

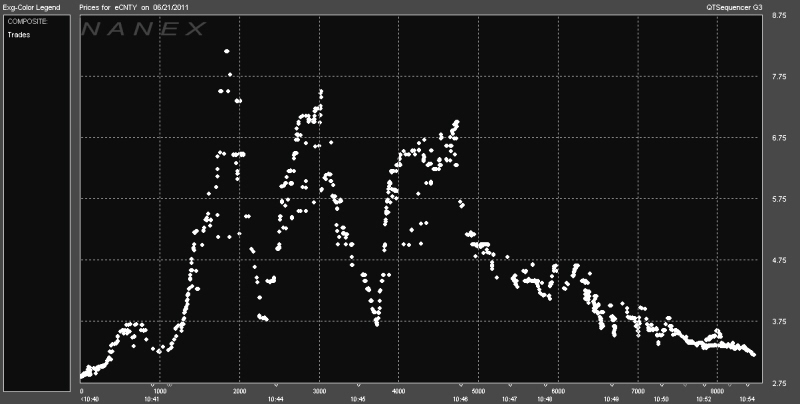

In this chart we have removed all quotes and plotted only trades:

In this chart we color the canceled trades orange:

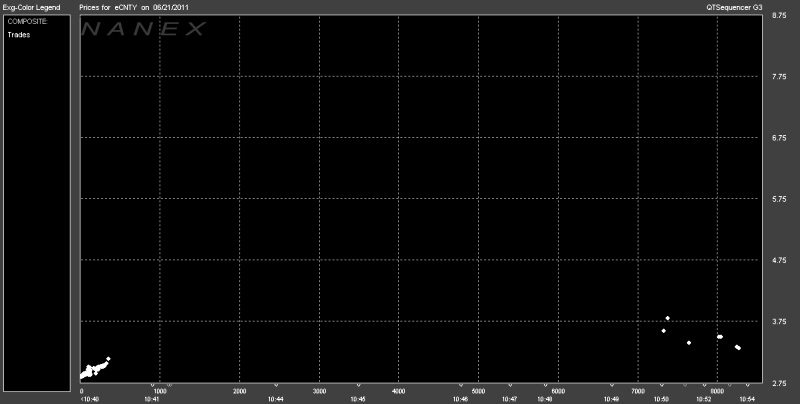

Finally, the next chart shows the trades with the now canceled trades absent. "Nothing Happened", just another Algo In The Mist.

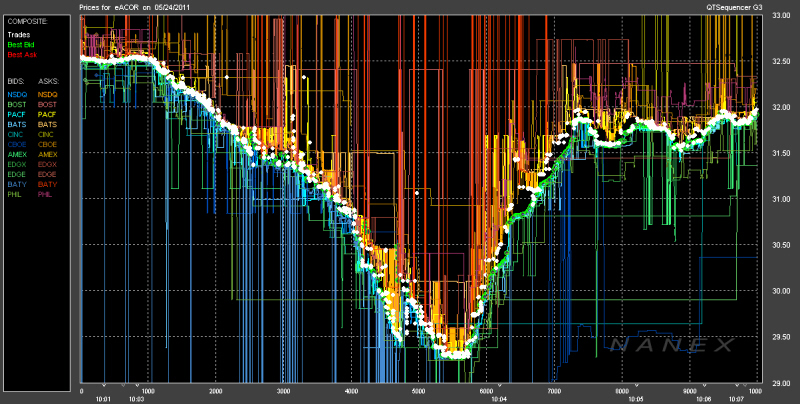

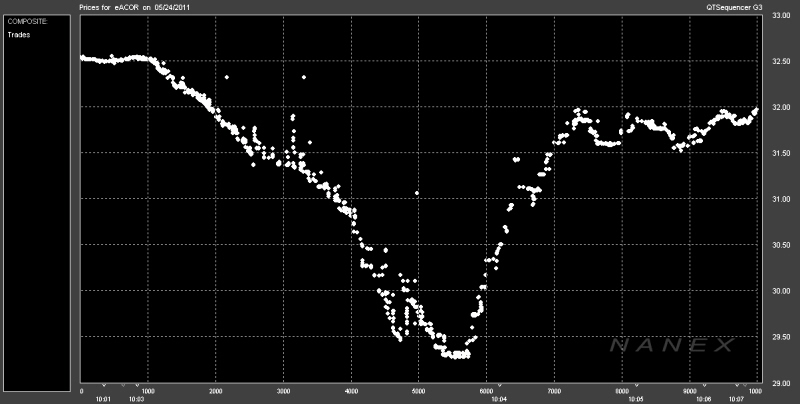

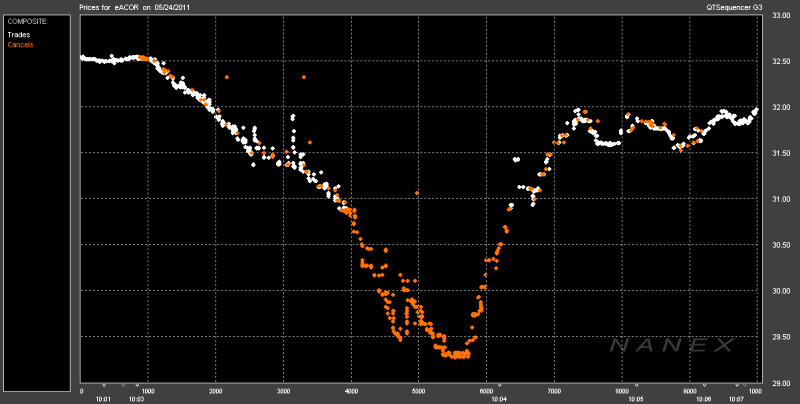

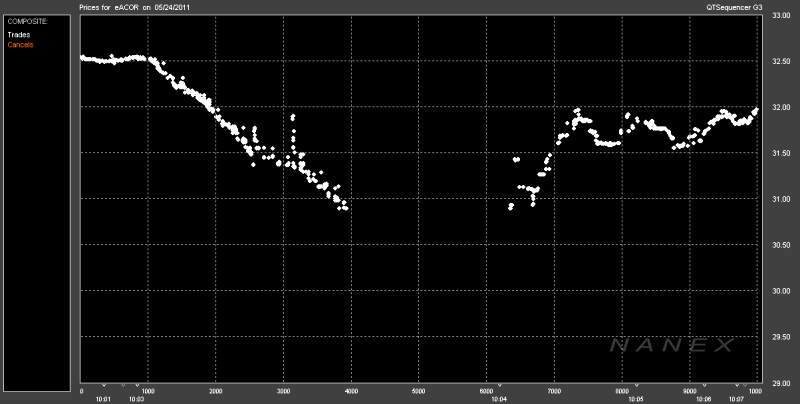

In the next example we show the stock ACOR on 05/24/2011. The stock lost approximately 11% of it's value in under 5 seconds then quickly recovered. While many of these trades got canceled, it's easy to see a few traders still got burned. Unfortunately, this trend will only continue if algos are allowed to conduct bad business that simply gets swept under the rug.

The following chart plots quotes and trades of the stock ACOR on 05/24/2011:

In this chart we have removed all quotes and plotted only trades:

In this chart we color the canceled trades orange:

Finally, the next chart shows the trades with the now canceled trades absent. Once again the regulatory agencies cancel the trades, close their eyes and pretend it never happened.

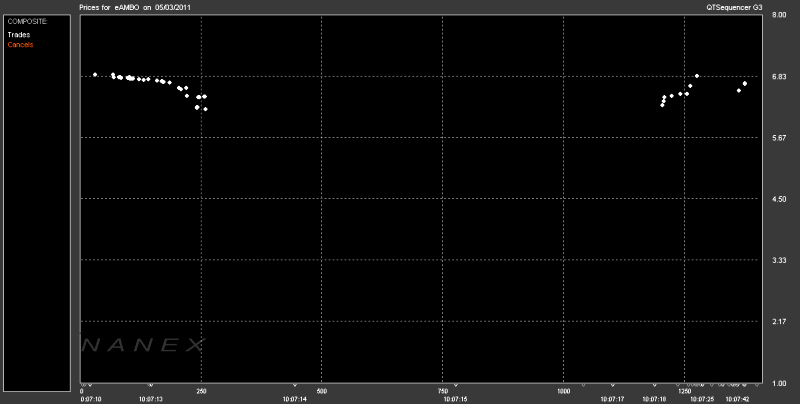

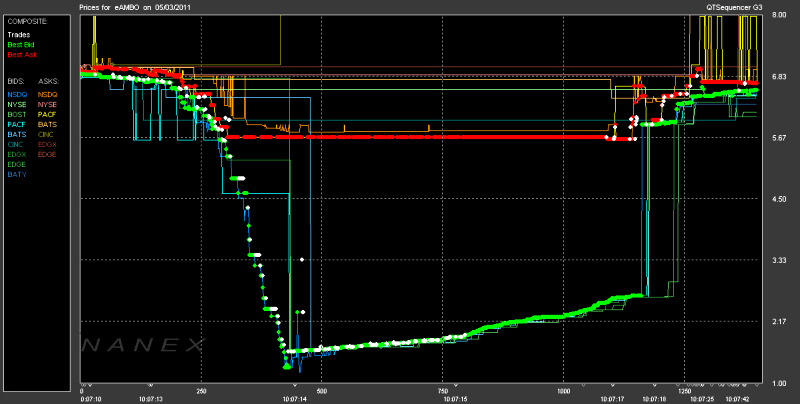

In the next example we show the stock AMBO on 05/03/2011. Shares fell from $6.74 to $1.59 within a single second:

The following chart plots quotes and trades of the stock AMBO on 05/03/2011:

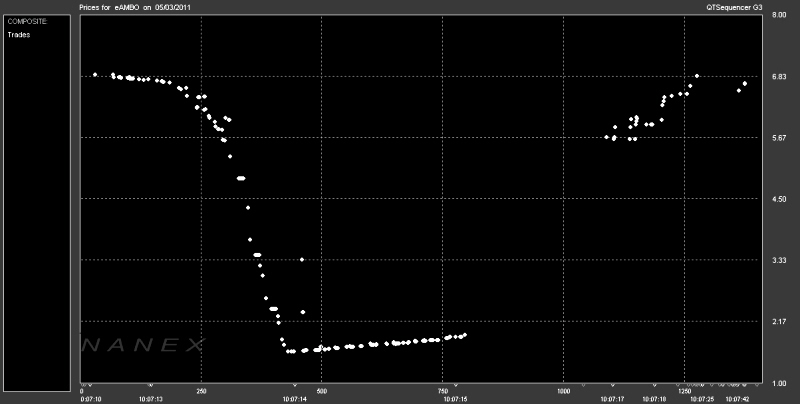

In this chart we have removed all quotes and plotted only trades:

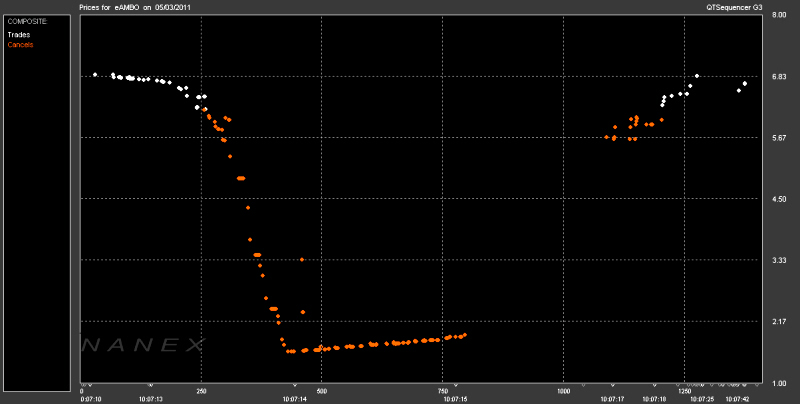

In this chart we color the canceled trades orange:

Finally, the next chart shows the trades with the now canceled trades absent.