Well here we have it, fresh off the post 2007 high's, Margin Debt is beginning to drop. The initial stages of this drop were observed back in March and we expect this to continue albeit minor increases. As spending habits change with seasons, more income will be spent on kids and their belongings for school, along with elders prescriptions and heating/gas expenditures close behind. The curve down hasn't been this steep since March of 2010, which is the only point in the past 8 years that shows a drop not being a part of a bigger drop.

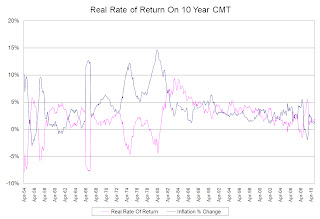

And just like the end of 2007, we see Free Credit Cash and Credit Balances increase as money is pulled from the system and held until the next buying opportunity presents itself, lets just hope that the leverage increase we see in the green line over the red isn't repeated. Also expect more draw down as investors take money to cover the increasing food cost thanks to Bernanke and Co. Take a look at the real rate of return on a ten year US constant maturity treasury bond given the annual change in CPI-U. Once the people realize they have negative real returns, they'll leverage up the risk in the equity markets and back to 2007 we go!